PMQ - Home Financing Made Easy & Instant

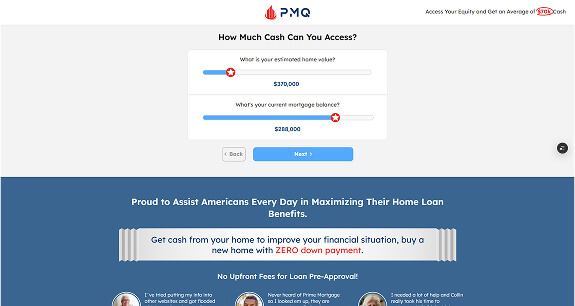

PMQ, a client in the home financing industry, approached Glorywebs with a vision to build a next-gen mortgage platform that simplifies refinancing, cash-out options, and new home loan approvals for users through a seamless digital experience.

The client aimed to offer a fast, intuitive, and intelligent solution where users could check their eligibility, explore loan options, and get customized mortgage quotes all without the traditional paperwork and delays.PMQ also wanted to leverage AI automation solutions to modernize backend operations, including underwriting and document verification.

AI Solutions

PMQ wanted to streamline the traditionally manual and time-consuming underwriting process, which involved analyzing various financial documents, verifying income, and assessing risk.

Solution: Glorywebs integrated AI-powered document processing and risk analysis tools, enabling the platform to extract, interpret, and validate user-submitted documents automatically. This significantly reduced review time and allowed underwriters to make quicker, more informed decisions.

PMQ needed a way to instantly deliver tailored loan options based on user inputs such as income, credit score, property value, and loan goals without overwhelming users with irrelevant offers.

Solution: We developed a dynamic recommendation engine using AI and real-time data modeling. The platform instantly delivers personalized loan suggestions by combining financial inputs with pre-trained models, improving user engagement and trust.

Faster Loan Pre-Approvals

Accuracy in Document Parsing

Increase in Qualified Lead Conversions

Uptime with Blazing-Fast Performance

We help Businesses to Innovate, grow, and evolve

Years of Experience

Projects Delivered

Retention Rate

Talents

Connect with us to get the support for your next challenge!