Quick Summary:

This comprehensive guide explores how automated loan processing systems are transforming the lending landscape. By integrating technologies such as AI, machine learning, RPA, OCR, and cloud APIs, lenders can streamline processes from loan application intake to underwriting and disbursement. Whether you’re a traditional lender or a digital disruptor, automation is no longer optional; it’s a competitive imperative.

Table of Content

- Introduction

- What is Automated Loan Processing?

- Technologies Powering Automated Loan Processing

- Business Benefits of an Automated Loan Processing System

- Common Use Cases Across Lending Ecosystem

- Manual to Automated: Roadmap for Financial Institutions

- Challenges to Watch & How to Overcome Them

- Final Thoughts: The Future of Lending is Automated

- FAQs

Introduction

What if we tell you that while you are manually checking and verifying loan applications, your competitors are closing more deals?

Although manual loan processing once dominated the industry, it is losing its pace due to the emergence of faster, automated, data-driven environments. Now, the same old manual method is a bottleneck that every lending institution, fintech startup, bank, and NBFC wants to eliminate.

Out of several lending agencies that implemented automation, we have gathered data from a few that noticed jaw-dropping results:

- USA’s regional banks witnessed an 85% reduction in loan processing time.

- Another US mortgage company automated loan production and noticed an efficiency improvement by 30%.

Several such companies implemented automation to eliminate manual errors, reduce loan processing times, and everything in between. You are at the right place since you are dealing with such a problem and seeking a solution. This article will tell you the areas where you can automate and what features need to be implemented. So, do not miss out on a single piece of information before deciding.

What is Automated Loan Processing?

It simply means utilizing cutting-edge loan functions, artificial intelligence, machine learning, robotic process automation, and optical character recognition to automate all possible loan-related functions.

It includes loan application processing, credit assessment and approval, underwriting, and disbursement automation.

This eliminates the need for manual interventions and errors, improving consistency and reducing turnaround time.

Here are the key components of Automated Loan Processing:

Data Extraction &Validation

One key component is data extraction from customers’ uploaded documents (ID, income proof, or bank statements). This happens swiftly using AI-powered document readers and OCR. Lastly, the validation occurs on time and accurately on pre-set rules or databases.

Credit Scoring

Using Machine Learning to assess the customer’s credit score ensures that the loan approved doesn’t become a bad debt. The assessment includes evaluating credit bureau records, income, social behavior, and transaction patterns. This allows the ML model to be continuously trained over time.

Automated Decision Making

As continuous data is fed into the system, it implements predefined policies and risk parameters to enable auto-approval, loan rejection, or flagging of loan applications.

Digital Documentation & E-signature

Once everything is approved, the loan agreement is automatically generated and shared digitally. Borrowers can quickly review and sign documents securely, enabling a complete paperless experience.

Technologies Powering Automated Loan Processing

Behind every task that frees your manpower, saves time, and ensures fast processing lies a set of cutting-edge technologies. It helps borrowers easily access, get approved, and receive loan amounts while processing documents, analysing borrower risk, and performing legal formalities on behalf of the lender. Let’s explore key technologies driving this transformation.

Artificial Intelligence

Artificial intelligence learns from historical data and estimates the borrower’s likelihood of paying the loan amount. It also leverages natural language processing to evaluate documents such as income proof, bank statements, IDs, or employment letters.

Use Case:

Automate customer data extraction from the income tax return and use it to assess eligibility.

Machine Learning

Machine Learning is a subset of artificial intelligence that learns from data, adapts, and improves over time. ML models evaluate numerous data points, such as credit history, income patterns, or spending habits, to assess risk scores. Moreover, ML helps identify unusual patterns that might be potential fraud, inconsistent information, or duplication.

Use Case:

Helps identify high-risk borrowers by evaluating historical transaction patterns and making decisions accordingly.

Robotic Process Automation

RPA leverages software bots to replicate human tasks, such as copying data from an application form and filling it into the system, or verifying KYC documents. Since these are repetitive tasks, automating them would save ample time, eliminate errors, and ensure faster decision-making.

Use Case:

It helps fetch details from a passport or ID card and autofills them into the core system within seconds. Learn more about how RPA in Banking is revolutionizing operational efficiency across the financial sector.

Optical Character Recognition

This technology reads text from images and PDFs, then converts it into digital data. With such a system, you can extract only key data from hard copies for feeding purposes. When OCR is combined with AI/ML, it becomes quite powerful in evaluating and categorizing document types.

Use Case:

Reads and digitizes bank statements, salary slips, and ID cards so the system can fetch details without hassle.

Cloud Integrations & APIs

Last but not least, cloud integrations and API usage to interconnect systems with CRMs, credit bureaus, and analytics dashboards are amazing technological adoptions. They ensure that every department has real-time access to the data and is on the same page.

Use Case:

The loan app pulls credit scores from the bureau, extracts customer history from CRM, and then makes loan approval decisions.

Smarter loans start with smarter systems.

We build automation that reduces turnaround time and increases conversions.

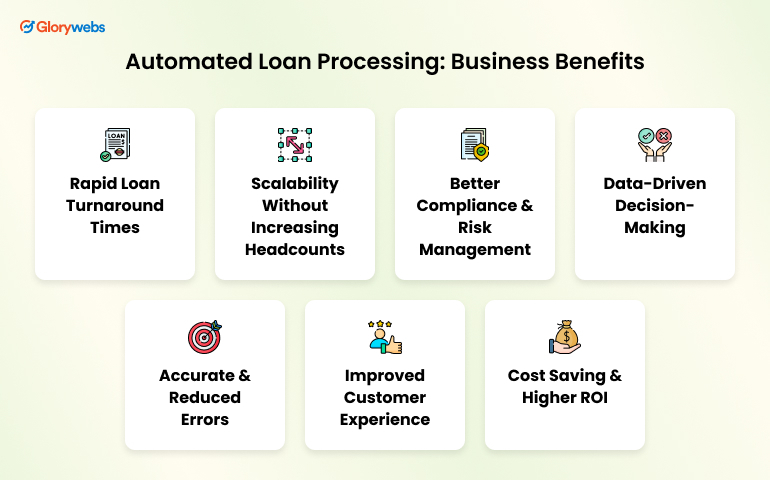

Business Benefits of an Automated Loan Processing System

Implementing automation isn’t the only benefit lending companies receive; there are several other key benefits that the companies enjoy, which are as follows:

Rapid Loan Turnaround Times

Traditionally, processing a single loan took a considerable amount of time, resulting in reduced business generation for lending companies. However, with automation in place and cutting-edge technology, loan processing time is reduced by half. What once took months is now a matter of hours or even minutes. You implement AI in loan processing, eliminating manual data entry, document processing, and repetitive checks. Lenders only sit tight and fasten up their approvals and disbursals.

Result: Quicker access to credit and improved operational efficiency.

Read more about our case study: AI-Driven Financing Platform

Accurate & Reduced Errors

With automation in place, it enables consistent validation, reduces error risks, and relies on rule-based logic along with AI-driven checks. On the other hand, if humans handle the same tasks, there is a chance of errors and inaccuracies.

Result: Lesser rework, better reliability, and improved data integrity

Scalability Without Increasing Headcounts

Scalability is never an issue when automation is involved; therefore, regardless of the number of applications your system receives, it processes them systematically and seamlessly without requiring staff. You can always count on AI and ML, irrespective of the loan application count.

Result: Optimized workflow utilization and sustainable growth

Improved Customer Experience

Borrowers are already in search of funds, and offering them that in no time means hooking them for life. With a seamless digital experience, self-service applications, instant status updates, and faster approvals, all they are going to do is simply remain your most loyal customers for life, and that’s what implementing cutting-edge technology offers.

Result: higher customer satisfaction and improved customer retention ratio.

Better Compliance & Risk Management

Since loan disbursal is part of the finance sector, it needs to meet compliance requirements. Automation, audit trails, and built-in workflows ensure all documents are properly documented and compliant with internal policies and regulatory requirements.

Result: Reduces compliance risks and enables informed lending decisions.

Cost Saving & Higher ROI

Automation has been proven to lower costs due to less dependency on manpower, zero errors, and minimal processing times. It is also beneficial in the long run, as it pays off over time by improving efficiency and increasing processing capacity.

Result: Better allocation of resources and increased profitability.

Data-Driven Decision-Making

The system will automatically collect and analyze borrower data, then make lending decisions based on historical transaction patterns. Predictive analytics can even help identify upsells and cross-sells.

Result: Better strategic lending and improved portfolio performance.

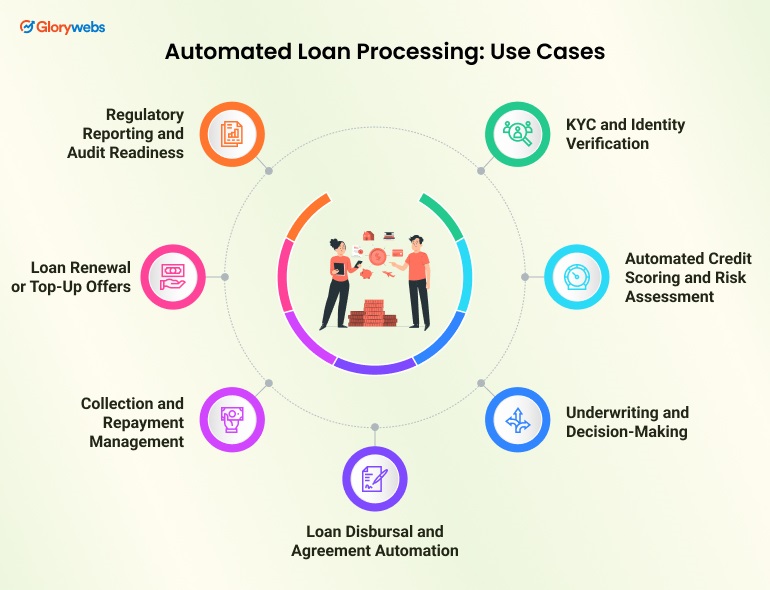

Common Use Cases Across Lending Ecosystem

Automation isn’t limited to loan application processing; it can also impact several other stages, changing the game and favoring the lending business’s origination.

By leveraging artificial intelligence and machine learning, you can expedite loan application processing tasks. Borrowers simply need to apply through their mobile applications or web portals, upload required documents, and get instant decisions.

Impact: quick turnaround times, better customer onboarding, and reduced abandoned ratio.

KYC and Identity Verification

KYC verification is instantaneous and hassle-free, thanks to technologies like OCR and RPA. The system automatically fetches, validates, and matches data from documents such as identification cards or pay slips.

Impact: Reduced fraud, prompt verifications, and regulatory compliance.

Automated Credit Scoring and Risk Assessment

AI and ML assess borrowers’ creditworthiness by analyzing their transaction patterns and utilizing both traditional and alternative data sources. This enables smarter risk profiling and better lending activities without the risk of bad debt.

Impact: improved risk management, expanded credit access, and minimized default rates.

Underwriting and Decision-Making

Automated decision engines apply preset rules and scorecards to approve, reject, or flag applications. Human underwriters only review exceptions, significantly reducing bottlenecks.

Impact: Reduces biases, consistent decisions, and rapid processing

Loan Disbursal and Agreement Automation

Once the application is approved, the system will automatically generate the loan agreement and send it to the borrower for their digital signature. After signing, borrowers receive their loan amounts through banking APIs.

Impact: seamless and paperless disbursal process with audit trails.

Collection and Repayment Management

Not only does the automation work best for loan disbursal, but it also ensures timely collection. Lenders receive notifications and reminders about lending, and borrowers are also notified of repayment plans and options. The system also shares payment links to ease the repayment process for borrowers.

Impact: Higher recovery rates and lower NPAs

Loan Renewal or Top-Up Offers

To enhance the user experience, the system analyzes loan repayment histories and then sends personalized offers to selected borrowers. This helps generate business by creating loops.

Impact: Increased upsell and cross-selling opportunities and improved lifetime value.

Regulatory Reporting and Audit Readiness

The activity log generates real-time compliance reports, simplifying audits and providing complete visibility into lending operations. This enables lending institutions, NBFCs, and banks to scrutinize their operations more closely.

Impact: lower compliance risk, faster audits, and stronger governance.

Manual processes slowing you down?

Automate loan workflows from start to finish.

Manual to Automated: Roadmap for Financial Institutions

Transforming the process digitally from a traditional approach involving tens of thousands of person-hours is a big decision. However, that is a great step towards being easily accessible to your customers and aligning with modern-day trends. Now comes a big confusion: what to automate and what not to; well, that’s no longer your headache. We have determined the process that will help you easily identify.

Assess Your Existing Loan Operations

Firstly, you have to identify inefficient areas of your loan operations. Are you still relying on manpower for data entry or document handling? Is loan approval time-consuming? Are there several errors that you can’t fix? Identify the labor-intensive, time-consuming, or cost-draining area and prioritize it first for automation.

If you are unsure, you can connect to an AI consultation company for a detailed analysis of your business operations.

Define Objectives

You should be clear about the automation expectations, such as what you want to achieve, including faster processing times, improved customer experience, better compliance, reduced costs, and faster KYC, among others. This will help you select the right technology stack and set up measurable KPIs.

Select the Right Technology

Now that AI/ML are almost ready to meet your expectations, it’s time to select the right tech stack:

- Use OCR for digitizing documents

- RPA for automating mundane tasks

- AI/ML for credit scoring and decision-making

- APIs for integrating with third-party systems

Implement Cutting-Edge in One Specific Department First

Don’t put all your eggs in one basket; this proverb is best here. You must not automate the entire process; instead, select an area, automate it, observe the results, and then proceed.

Integrate with Existing Infrastructure

You must seamlessly integrate workflows with existing systems, such as core banking, document management, and compliance modules. Ensure that data flows seamlessly between different platforms.

Train Teams & Define Roles

Implementing automation shifts not only business operations but also the working patterns of employees. As a result, you may need to train employees to handle strategic tasks, attend to attention-grabbing customer service requests, and perform data analysis.

Track, Optimize, and Grow

Once everything is set and live, you must monitor key metrics, including turnaround times, approval accuracy, and customer satisfaction. You can leverage this information to optimize processes and gradually expand automation to other departments.

Challenges to Watch & How to Overcome Them

You have several benefits of automation in loan processing, but is it as swift as it sounds? Well, there are roadblocks, but AI ensures everything still depends. We have listed a few challenges and solutions.

1. Legacy System & Siloed Data

Challenge: Many financial institutions depend on outdated systems that don’t integrate with modern automation tools.

Solution:

- Ensure the adoption of an API-first automation platform to layer over the legacy system.

- Ensure the implementation of data warehouses and a unified dashboard to manage information effectively.

- Gradually modernize core systems with modular upgrades.

2. Poor Data Quality

Challenge: Incomplete, inaccurate, unstructured data in the workflow leads to faulty credit decisions.

Solution:

- Make use of optical character recognition and AI to structure incoming data.

- Implement data validation checks and feedback loops to improve data quality.

- Train ML models with diverse and verified datasets.

3. Compliance & Regulatory Concerns

Challenge: Automated decisions must adhere to strict financial regulations. Lenders fear non-compliance or a lack of auditability.

Solution:

- Choose automation tools with built-in audit trails and compliance modules.

- Include legal and compliance teams in designing automated workflows.

- Ensure explainability in AI decisions for credit scoring and risk assessment.

4. Employee Resistance to Change

Challenge: teams feel pressure and fear of job loss due to automation.

Solution:

- Communicate the benefits of the automation tools, less repetitive work, and upskilling opportunities.

- Include staff in the automation journey through training programs.

- Redetermine the roles to shift their focus to strategic tasks.

5. High Initial Investment

Challenge: High upfront investment is required in areas like infrastructure and training.

Solution:

- Start with a small pilot program.

- Opt for cloud-based, subscription model platforms to reduce capital expenditure.

6. Lack of Internal Expertise

Challenge: Not all lending institutions have in-house experts or AI specialists

Solution:

- Partner up with an AI development company.

- Use a no-code/low-code platform to empower business users to configure workflows.

7. Security & Privacy Risks

Challenge: Handling sensitive data in automation raises confidentiality concerns

Solution:

- Implementing strong encryption, role-based access control, and regular security audits.

- Selecting the platform that complies with data protection laws and ensures cybersecurity protocols.

- Implementing secure API integrations with external systems.

Final Thoughts: The Future of Lending is Automated

The digital world is pacing towards automation, and manual tasks are a thing of the past. With automated loan processing, lenders are empowered by speed, accuracy, and compliance, while also offering an unforgettable experience to borrowers.

With the technological adoption of AI, ML, RPA, and OCR, lending institutions can reduce turnaround times, operational costs, and make informed decisions. Whether you are an NBFC, lending institution, or fintech company, automation is the only way to sustain the fast-paced market. So, don’t wait any longer; connect with Glorywebs today and discuss your requirements.

FAQs

The modern loan automation systems are built with enterprise-level security. They also offer security features like audit trails, access control, role-based access, and encryption. Along with this, they also adhere to compliance with GDPR, CCPA, and local lending laws. Besides, automation ensures there are no manual compliance errors or risks.

The transition starts with process mapping, identifying automation-backed workflows, integrating cutting-edge tools, and gradually scaling to end-to-end automation.

Several lending institutions have invested in AI for loan fintech and have achieved 5x faster processing times, a nearly 70% reduction in operational costs, improved customer satisfaction, and minimal errors, resulting in more rapid decision-making.

Automation isn’t limited to large banks; even small and mid-size lending agencies can implement it to reap the benefits. It helps to stay accurate, consistent, fast, and aligned with market trends.

The timeline for AI implementation depends on the project scope, the level of AI integration, and the degree of personalization. A basic automation takes somewhere around a few months, while complex or entire process automation will take around 12-15 months.

AI models evaluate thousands of data points, including credit history, spending patterns, and alternative data such as education or employment trends, to assess borrower risk more accurately. This minimizes biases and errors common in manual evaluations.

Comments